Spring is here 🌻!!!! My life update, for those of you who don’t know, is that I recently returned from paternity leave after having our second son, George. Our 20-month old, Jack, is settling in well as a new big brother!

As I’ve been growing my own family, we’ve also added to our GGR family, having recently brought on our newest Talent Partner Mia at the beginning of March (more about her below)!

Time for some updates! TL;DR with details below:

New team member Mia 🧑💻

2022 Compensation Survey data 🤑 check out a sneak peek of the results

If you haven’t filled out our survey, there’s still time and you’ll gain access to the full database once completed!

Quick market update and thoughts on the hiring landscape

❤️ Phil and the Golden Gate team

Mia Introduction

Mia just joined Golden Gate Recruits as a Talent Partner, and we’re so excited to have her on board! In typical generalist fashion, she’s had a great mix of experiences, starting at Deloitte before spending time at Hello Alfred and Cartier in their Innovation Lab (yes, the jewelry company!).

Mia graduated from Princeton, is from El Paso, TX originally, currently living in NYC but moving to Birmingham, Alabama soon with her husband! She loves cycling, ceramics, and truly any film produced by A24.

Her email is mia@goldengaterecruits.com, and she’d love to chat.

Brief Market Update

We’ll keep the “market” update fairly short. The job market continues to be relatively soft. Companies are hesitant to add new headcount, while being even more selective around who they ultimately pick. Given the strong pool of candidates out there - many of whom are desperately looking for work - candidates on the whole have less leverage when it comes to negotiating outsized offers.

More generally, if your exploration and processes aren’t going quite your way, hopefully it’s a bit helpful to hear that we’re seeing this across the board with candidates who are searching right now and it’s probably not you.

That said, candidates can feel confident that the companies who are currently looking to grow are in fact doing really well, and positioned to weather whatever happens over the coming months/years.

The billion dollar question that everyone is asking us is “what is your guess on timing?” No one can predict the future, and anyone who tells you that they can probably doesn’t know what they’re talking about 🙃. That said, we feel fairly confident that the slowdown in startup/tech hiring is going to last at least another few months. It might be 6 months. It might be 12 months. It might be longer. It doesn’t feel like we’re out of the woods yet, but we’ll see what happens….if anyone has thoughts, we’re all ears!

2022 Startup Compensation Data

We wanted to highlight some of the results from our most recent Compensation Study which gathered a variety of data on 2022 compensation. We had almost 500 people respond so far and are sharing a few of the main takeaways from the study below ⬇️.

Quick reminder:

We collected data for the “2022 Survey” in the early months of of 2023.

We collected data for the “2021 Survey” at the beginning of 2022.

Quick observations:

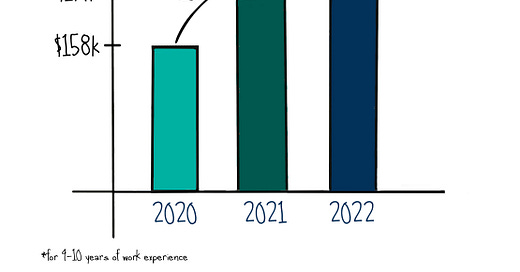

Compensation has remained basically flat since our 2021 Comp Study. We saw a nominal % increase, relative to last year’s data, but not matching inflation. This stands in stark contrast with what we saw between 2020 and 2021, where comp witnessed a 10%+ increase.

These general trends are consistent with what we're seeing across the startup landscape:

Particular industries are witnessing compensation compression (e.g, consumer, healthcare), with the pendulum swinging back towards a focus on profitability.

It’s a company’s market, not a candidate’s. While you shouldn’t be afraid to ask for what you’re aiming for, don’t be surprised if companies push back or say they don’t have room to budge. Expect that they’ll have other candidates in process that they can turn to if you decide to haggle.

Companies are less willing to flex up more junior candidates into more senior roles, both on compensation and title (e.g. manager-level candidates getting a director title). We noticed this across the board in 2021 and early 2022 as companies were fighting for talent.

Other fun facts we uncovered:

Almost 90% of respondents said they prefer some type of hybrid work setup, either selecting “Option to work in-person and/or remote, but with offices” or “Required to live in a city with an office but have the option to work from home some days.” This is similar to last year ~85%.

Over 80% of respondents said they negotiated their initial offer, though the vast majority of negotiation results in a <20% increase in cash or equity in the end.

By the numbers:

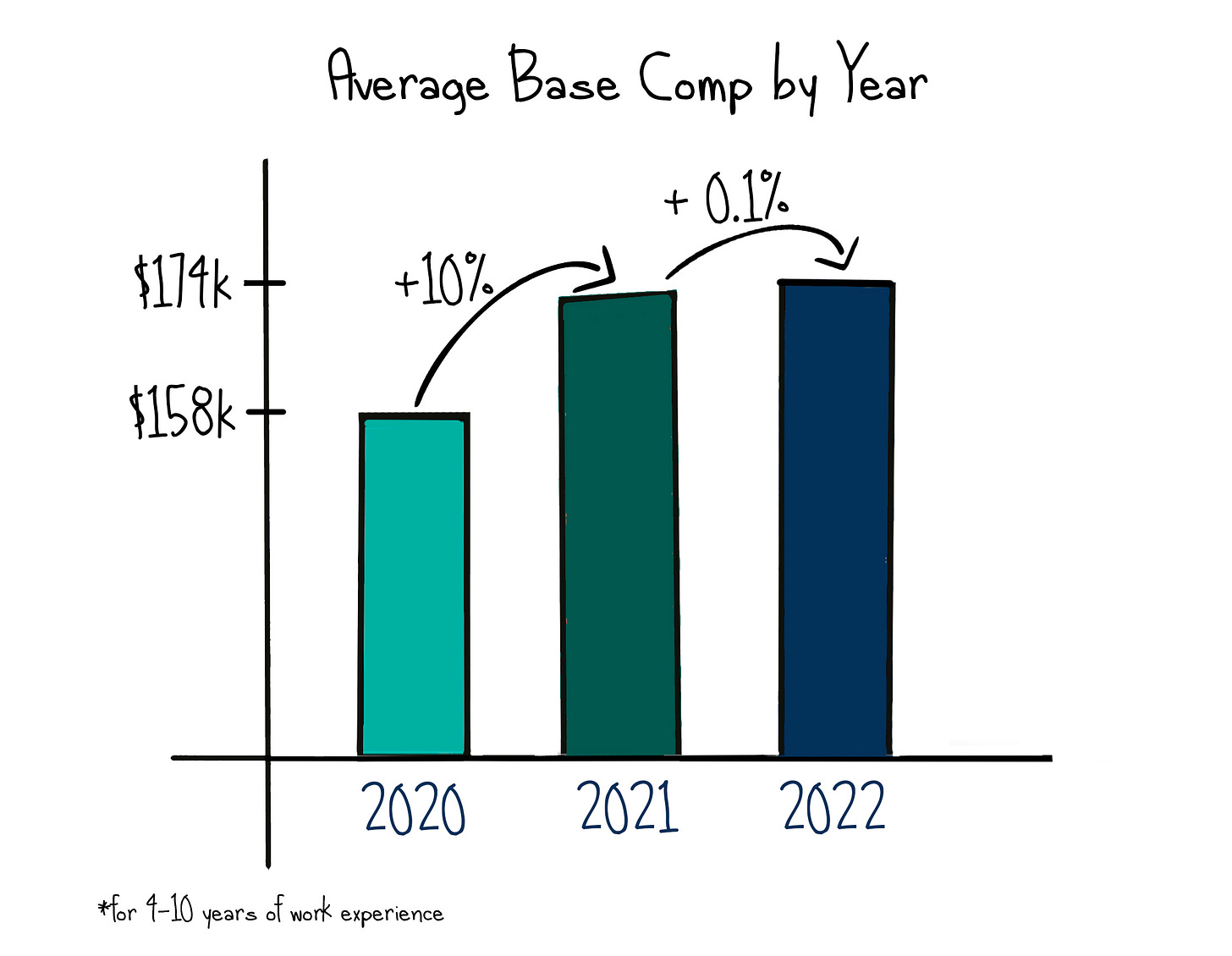

San Francisco takes the cake: The Bay Area continues to have a slight compensation premium compared to the rest of the country.

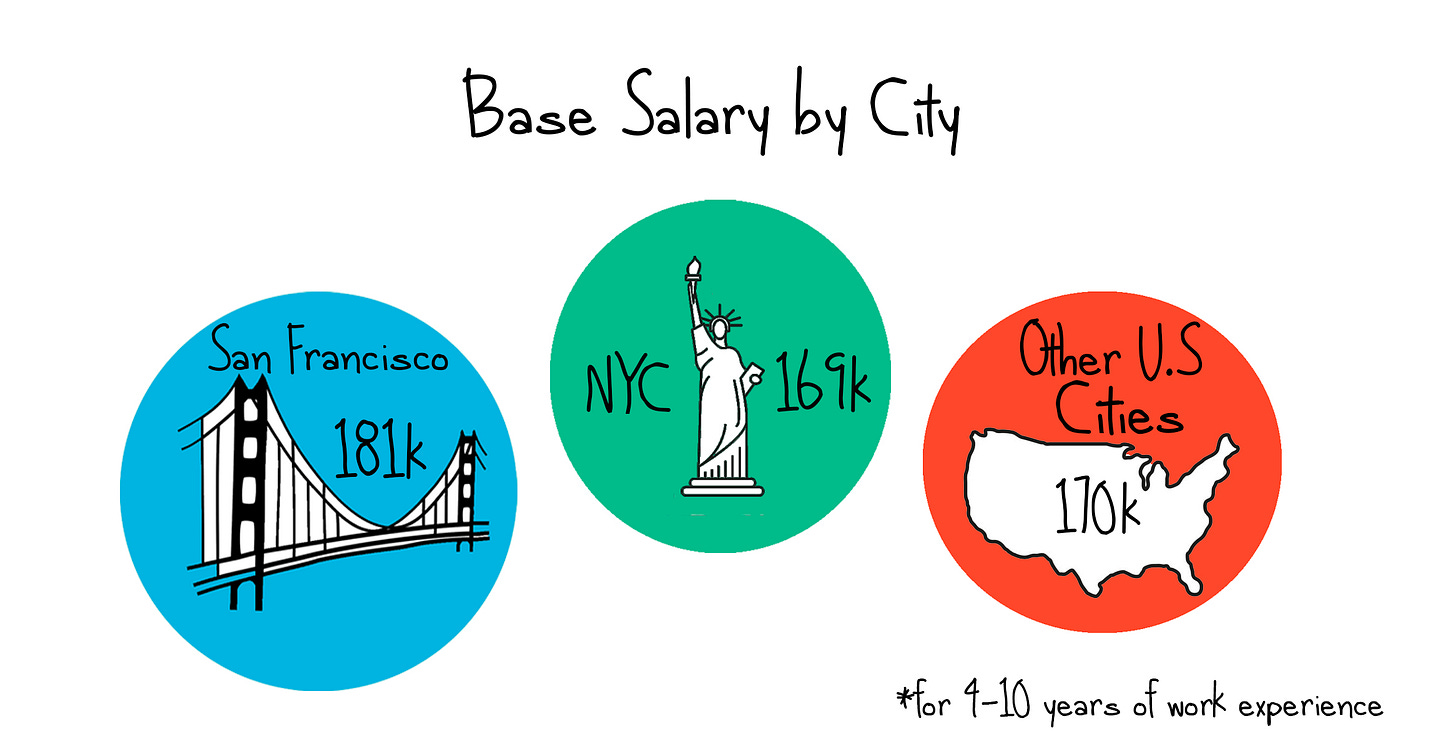

The 51-200 person sweet spot: Larger base salaries typically corresponded with larger sized companies, however we saw well-funded growth stage companies flush with cash in 50-200 people average the largest base.

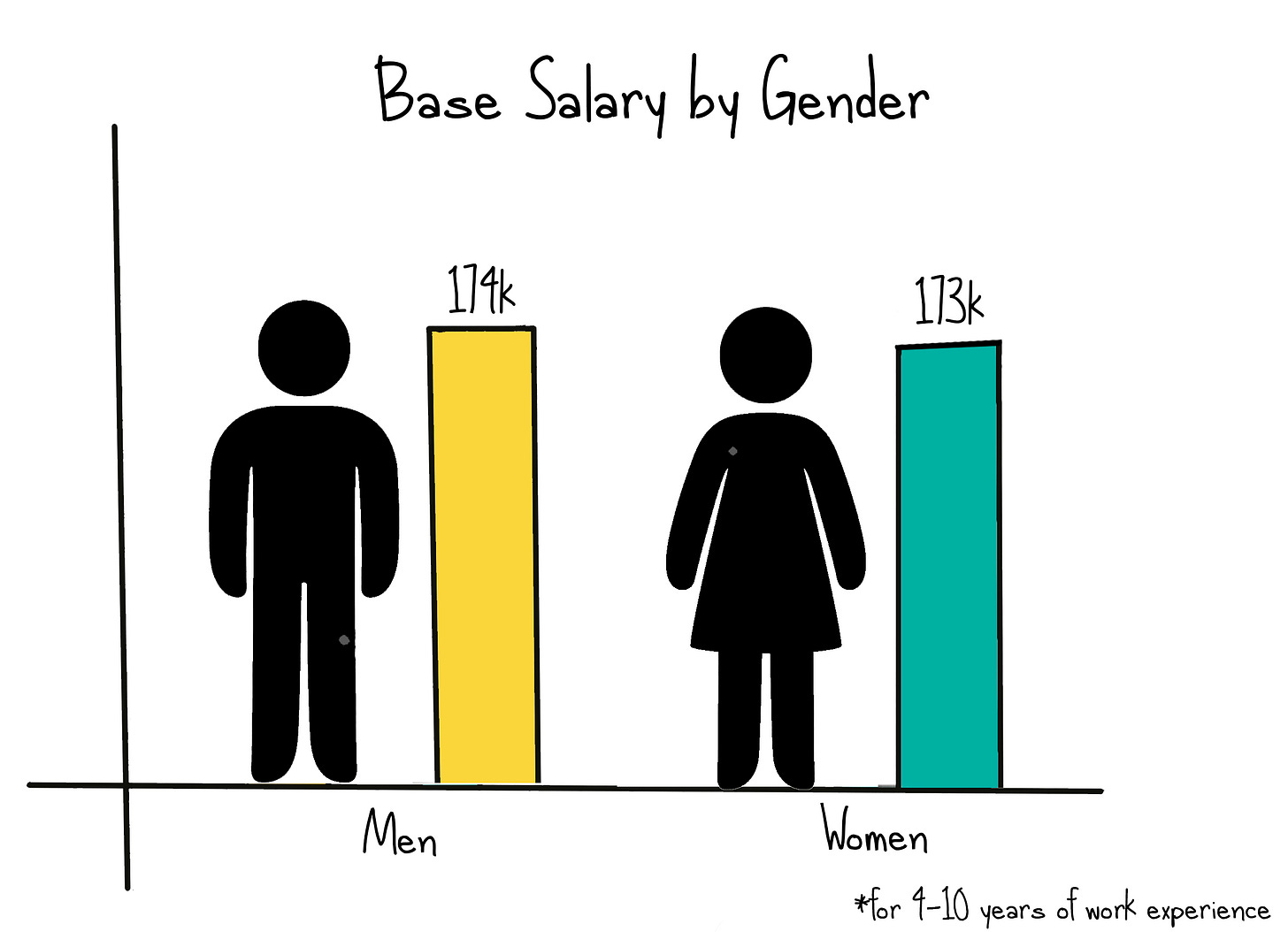

Comparable across gender: We’re heartened to see that base salaries held by both genders are relatively similar, with men at only a slightly higher base than women 🥳. There’s still work to be done but we’re making progress.

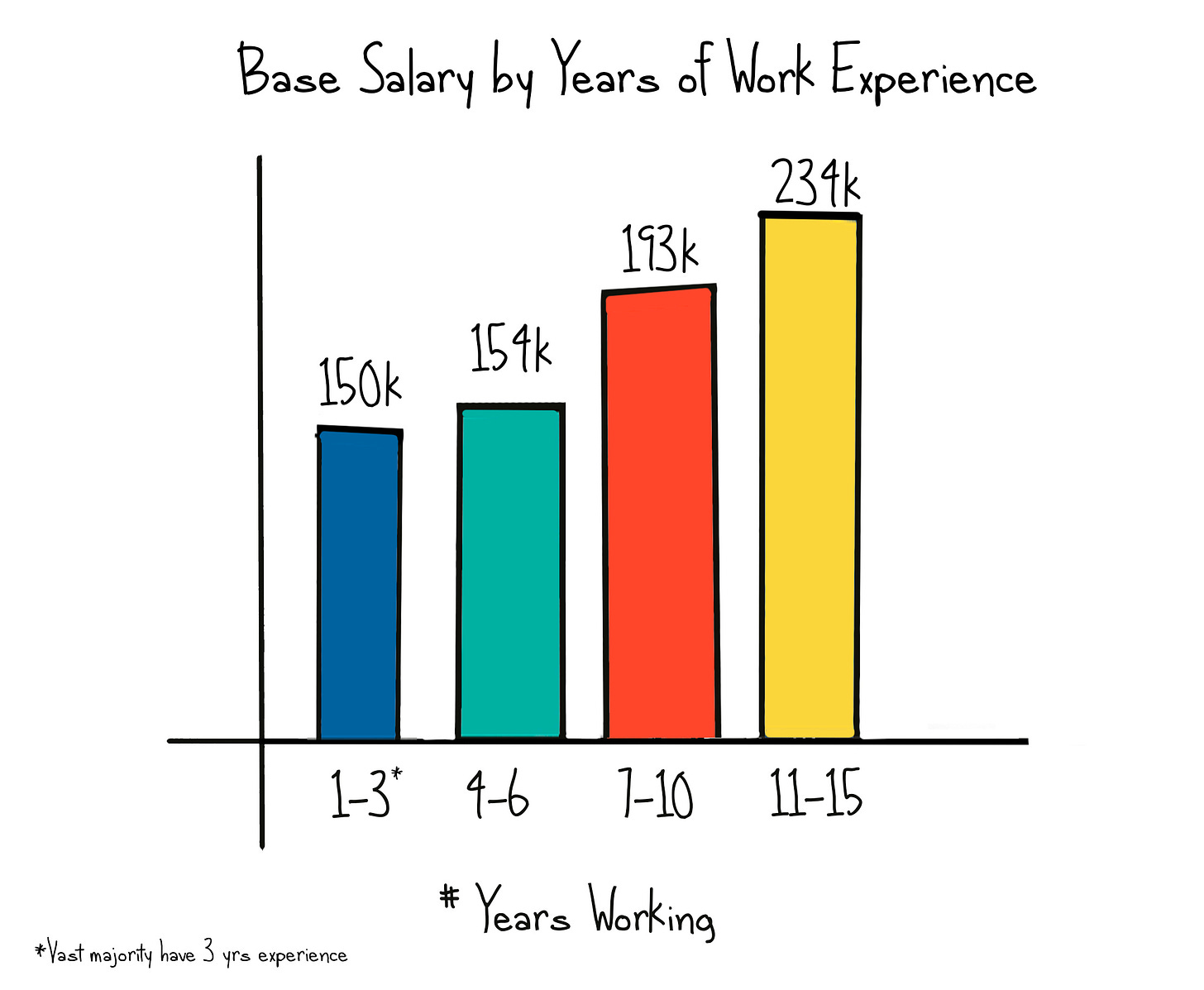

Moving on up: No surprises here - with data indicating that years of works experience correlated with salary.

A big THANK YOU to everyone who filled it out this year! You should have received the full data set via email already (let us know if you haven’t).

For those who haven’t filled it out yet, you still can! Once you do, you’ll get instant access to our 2021 compensation study and then we’ll send you the 2022 data. Here's the link to the survey ➡ 2022 GGR Comp Survey

Open Roles

Our company partners are continuing to hire but we’ve certainly seen a slowdown in new roles popping up. You can check out the roles we’re currently working on at our Openings page!

Some Content for Your Eyes & Ears

📈 “State of startup compensation, H2 2022” (Carta): More compensation insight, including startup salaries and how layoffs are impacting hiring projections

📖 “Charts Charts Charts” (Investment Talk newsletter): Collection of relevant and interesting visuals tracking current state of the global economy

🎧 “Is it Time for Public Checking Accounts at the Fed?” (Odd Lots Podcast): Discussion with Cornell Law professor in the wake of the SVB situation

Love that you do these — such a great service. Congrats on the growing team and growing family!

Congrats on the baby! And thanks for the great update!