Hope everyone is enjoying the start of spring 🌸 😎! Keeping it brief because everyone seems busy (in a good way!) ….

Market is feeling healthy! We’re very busy for the first time since 2022 and continuing to kick off new roles. Things have picked up and companies are showing a lot of urgency - we’ve been hearing a lot of “I NEED this role yesterday!” Check out a few roles below ⬇️ and all the new stuff we’ve got @ GGR Open Roles

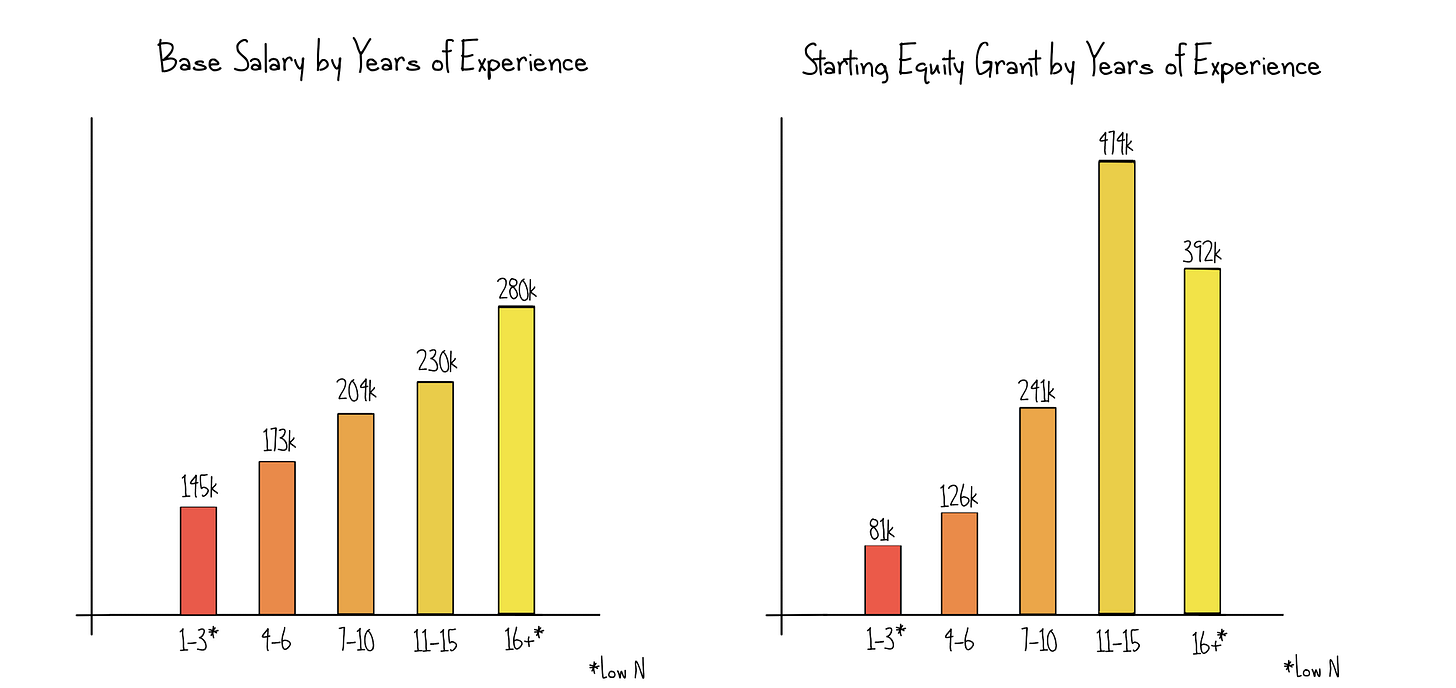

Our 2024 compensation charts are finally here! Scroll down for our comp survey data, captured in our standard graphics format that everyone loves 📊

❤️ Phil and the Golden Gate team

2024 Startup Compensation Data

We’ve had about 500 people respond to our 2024 Compensation Survey, and are highlighting some of the major takeaways below.

**As a quick reminder, we collected data for our “2024 Survey” at the end of 2024 through January 2025.

Quick observations:

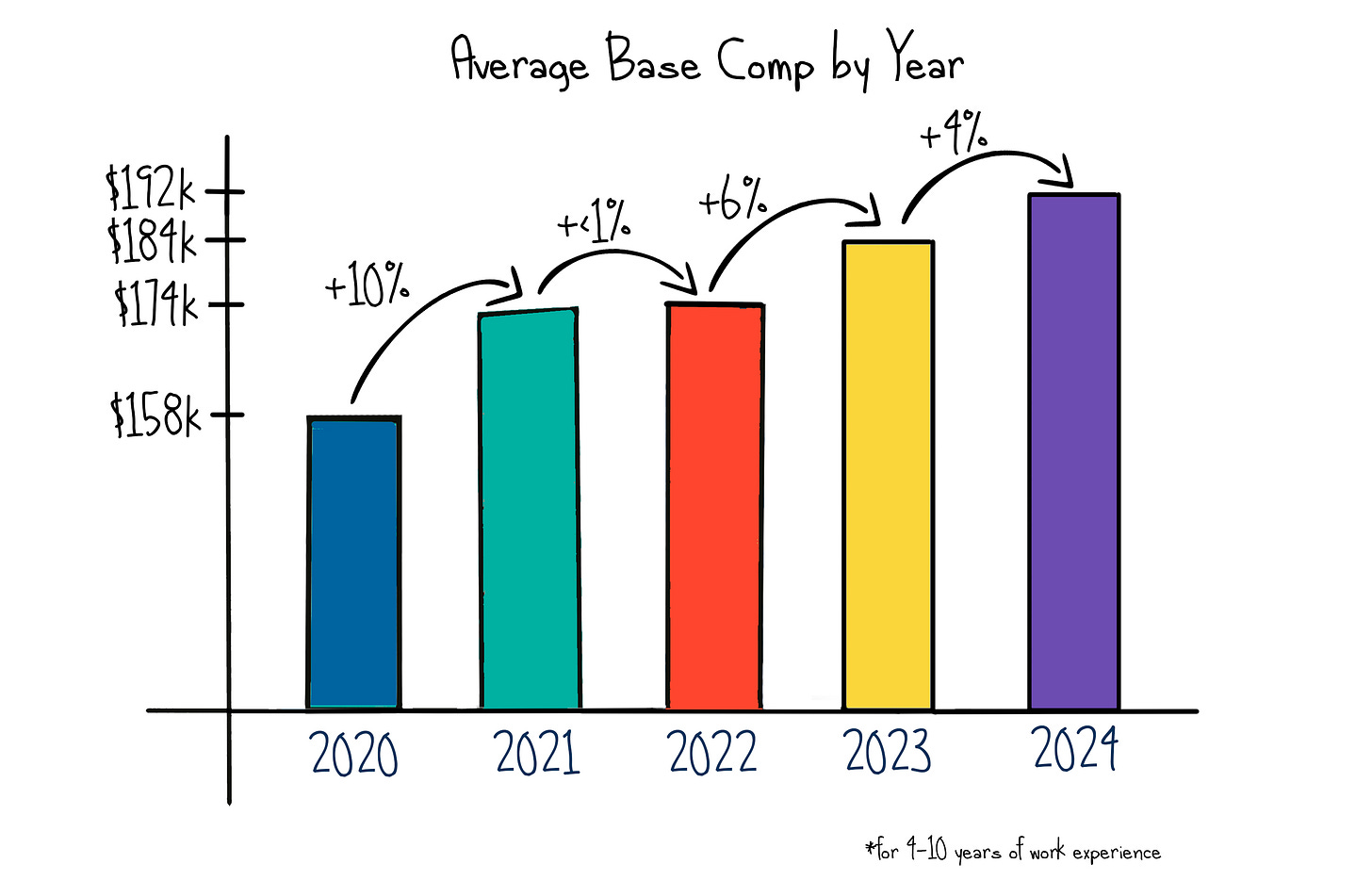

It was a decent year for cash compensation, though we saw a slightly smaller increase relative to last year (right around 4%). It’s safe to say that cash compensation more or less kept pace with inflation.

By the numbers:

Location: The Bay Area continues to command a slight premium compared to the rest of the country. Our POV is that this will likely continue due to talent competition among AI startups.

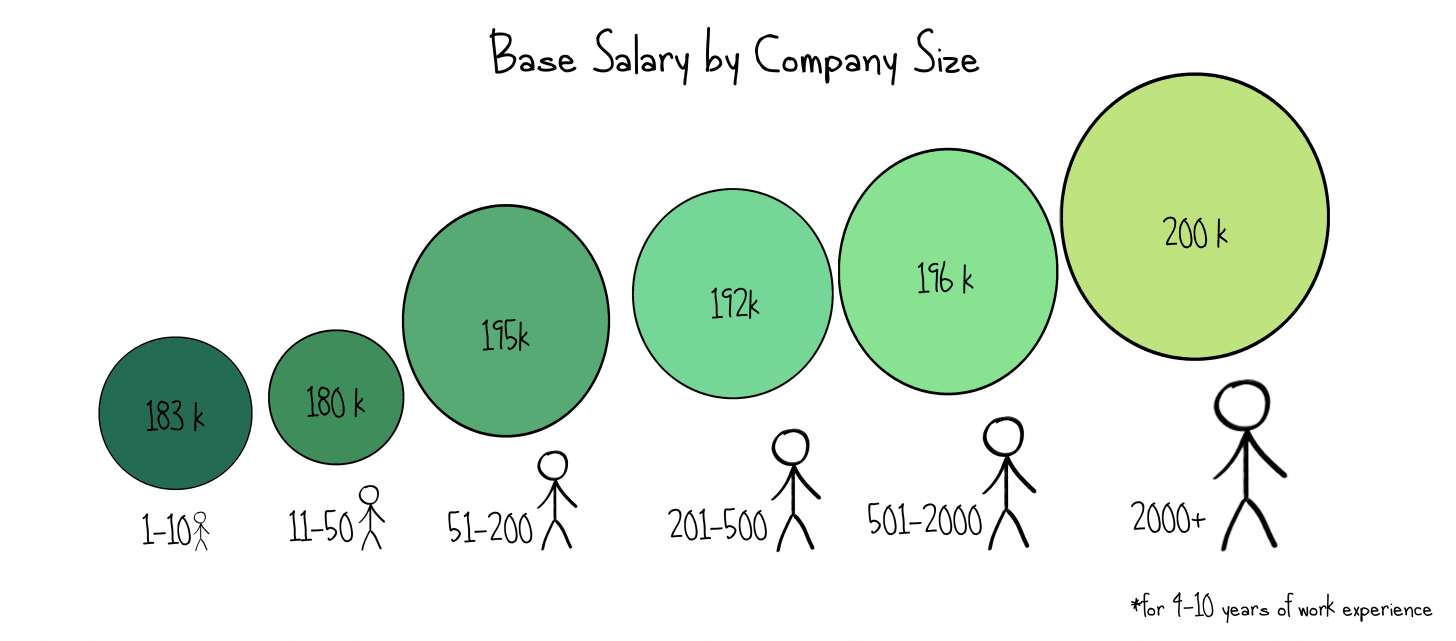

Company Size: Larger base salaries typically correspond with larger companies, which we saw play out this year (albeit with a slight edge amongst the well-funded, growth stage companies in the 50-200 people range).

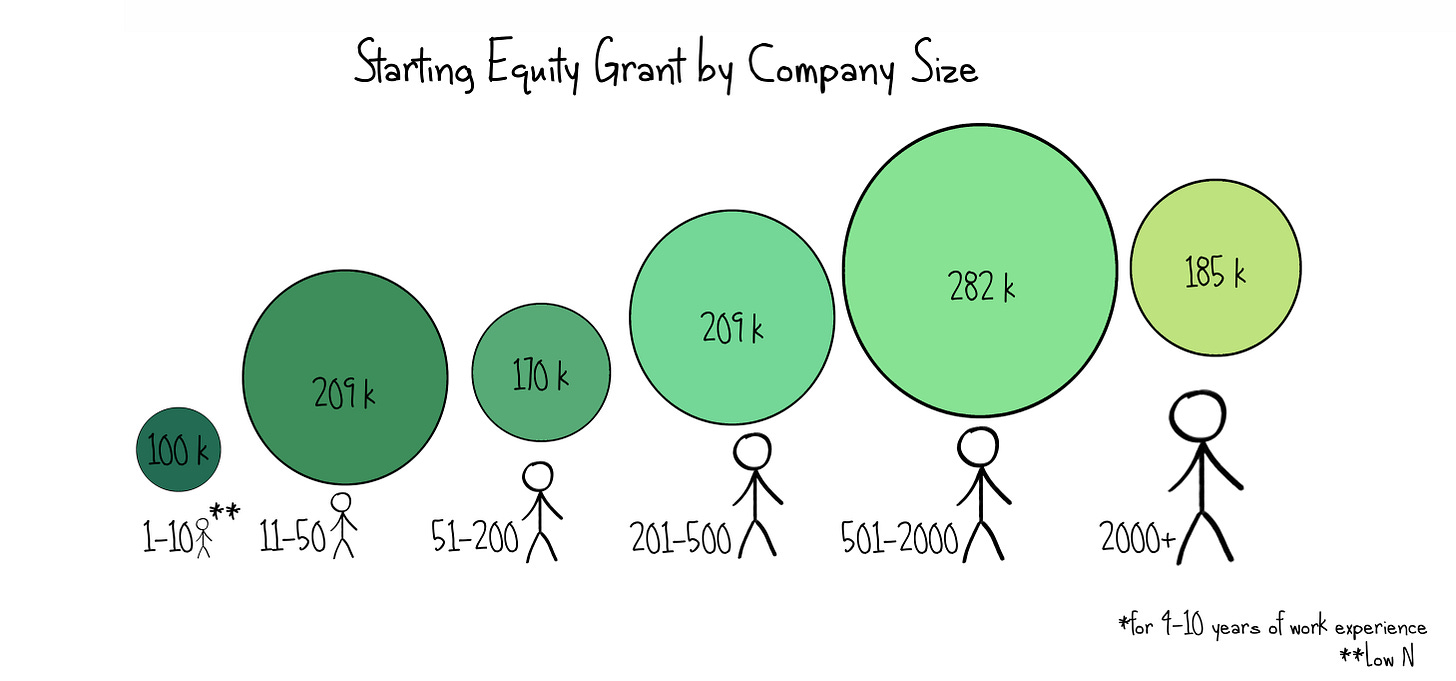

Equity Grant: Not totally surprised to see that equity is all over the place across company size/stage (e.g., Seed/Series A startups raising at crazy valuations). A good reminder to always do your due diligence when negotiating your offer, ask about equity/value up front, and ask about the company’s overall compensation philosophy (e.g., equity refreshers). If companies aren’t transparent and forthcoming, that’s a flag for us….

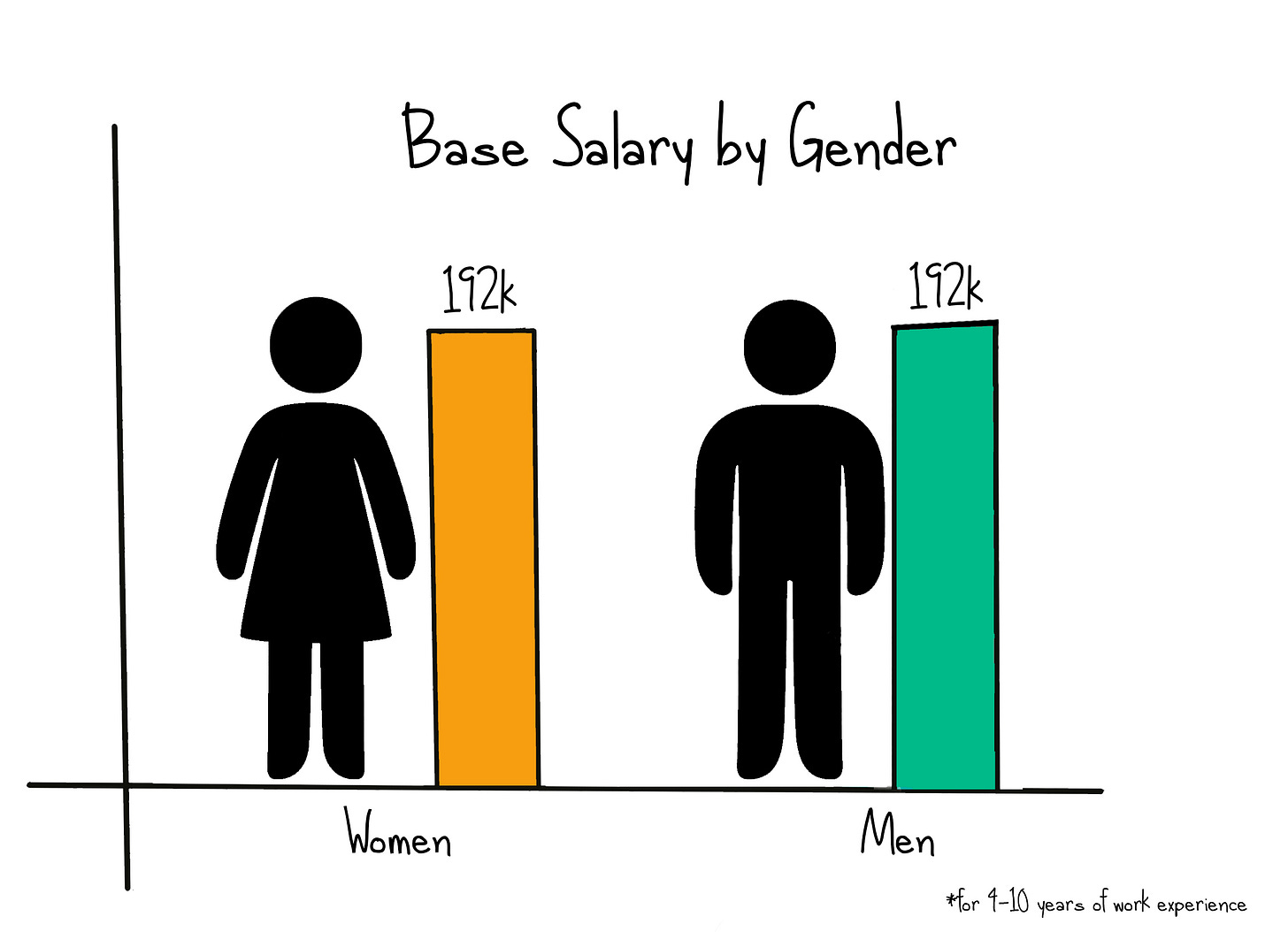

Gender: We’re excited to see that base salaries by gender were equal this year; a great sign and one we hope we’ll continue to see each year!

Company Type: SaaS companies, both B2B and B2C, held the highest pay – definitely not a surprise and very much keeping in line with the growing number of AI companies taking off over the past year.

Years of Experience: As expected, years of work experience is highly correlated with both salary and equity grant.

A big THANK YOU to everyone who filled it out this year! You should have received the full data set via email already (let us know if you haven’t).

For those who haven’t filled it out yet, you still can! Once you do, you’ll get access to our 2023 compensation study and then we’ll send you the 2024 data. Here's the link to the survey ➡ SURVEY LINK. We’d also highly recommend checking out Carta’s recent H2 2024 State of Startup Compensation report (shoutout Peter Walker!).

Open Roles

Check out a handful of roles working on below, but as always, you can review additional opportunities our Openings Page.

Undisclosed [VC Fund]: Incubations & Research Lead

This fund invests primarily in early stage technology companies, leading rounds from seed to growth across various pillars (software, data, AI). They're looking for their first Incubations Lead to research high conviction business theses to develop, and then build from 0 to 1. Palo Alto-based, in-office working model.

Anam [AI SaaS]: BizOps Lead

Anam is seed stage startup creating AI personas that engage in natural, real-time conversations, enabling more personalized customer service experiences. They’re looking for their first strategic business hire to focus on everything non-technical (operations, fundraising, customer delivery, talent, finance, sales), with an initial focus on GTM and BD. NY-based, in-person working model.

Mux [SaaS]: Head of Strategic Finance

Mux is a Series D video streaming infrastructure platform that helps developers to build video into their products. They’re looking for a Head of Strategic Finance to own financial strategy, planning and analysis and lead high-impact, cross-functional projects across the business. Remote working model.